louisiana inheritance tax waiver form

If youre looking for more guidance to navigate the complexities of Louisiana inheritance laws reading up on them beforehand will be a huge help. Louisiana does not impose any state inheritance or estate taxes.

Free Louisiana Name Change Forms How To Change Your Name In La Pdf Eforms

All groups and messages.

. REV-1197 -- Schedule AU -- Agricultural Use Exemptions. Failure to get the form exactly right will result in an invalid document or perhaps worse lead to estate litigation. Bulk Extensions File your clients Individual Corporate and Composite Partnership extension in bulk.

Request for Waiver or Notice of Transfer inheritance taxrev-516inheritance tax formsstocks bonds securities held in beneficiary form Created Date. REV-720 -- Inheritance Tax General Information. Corporation IncomeFranchise Extension Request.

This means that a state will not qualify as a small succession if the Louisiana property is worth more than 125000. The tax waivers function as proof to the bank or other institution that death tax has been paid to the State and money can be released. REV-714 -- Register of Wills Monthly Report.

INHERITANCE TAX DIVISION WAIVER REQUEST PO BOX 280601 HARRISBURG PA 17128-0601. Often in Louisiana one person will inherit the right to use property and receive the fruits income from property. Inheritance Tax Waiver List Revised 111405 State Inheritance Tax Waiver List The information in this Appendix is based on information published as of June 27 2005 in the Securities Transfer Guide a publication of CCH Incorporated or obtained from the applicable state tax agency.

If the decedent has been deceased for at least 25 years there is no value limitation. Although this is true in most states it is especially important in Louisiana due to Louisianas unique civil law system. This ratio is applied to the state death tax credit allowable under Internal Revenue Code Section 2011.

Effective January 1 2012 no receipts will be issued for inheritance tax regardless of the date of death. Until recently an estate would not qualify as a small succession if real estate is involved. Its also a community property estate meaning it considers all the assets of a married couple jointly owned.

Louisiana has completely eliminated taxes on any inheritance but for estates that are large enough to require a federal estate tax return there is a Louisiana Estate Transfer Tax. Find out when all state tax returns are due. The Department has eliminated the MO-1040P Property Tax Credit and Pension Exemption Short Form for tax years 2021 and forward.

The portion of the state death tax credit allowable to Louisiana that. Ad Get Access to the Largest Online Library of Legal Forms for Any State. In other words if you purchased your home in the 80s for 75000 and it is now worth 200000 you have 125000 of built-in gain.

This right is called a usufruct and the person who inherits this right is called a usufructuary. See MO-1040 Instructions for more details. Request for Waiver or Notice of Transfer Author.

Addresses for Mailing Returns. Because of Louisianas strict requirements it is particularly dangerous to rely on a generic Last Will and Testament form from a non-attorney. Form 8508-I To request a waiver from the electronic filing of Form 8966 FATCA Report use Form 8508-I Request for Waiver From Filing Information Returns Electronically For Form 8966 PDF.

In 2009 Louisiana law was amended to allow. For those who previously filed MO-1040P you will now file Form MO-1040 and attach Form MO-PTS and Form MO-A if applicable. Under the federal estate tax law there is a credit for state death taxes that are paid up to a certain amount.

For current information please consult your legal counsel or. No Act 822 of the 2008 Regular Legislative Session. Thus separate inheritance waiver form is louisiana income tax returns filed with louisiana state earned income tax as collections.

Instantly Find and Download Legal Forms Drafted by Attorneys for Your State. Repealed the inheritance tax law RS. PA Department of Revenue.

The potential INCOME tax rate on that built in gain even if all of it is classified as a capital gain is. REV-1313 -- Application for Refund of Pennsylvania InheritanceEstate Tax. REV-1381 -- StocksBonds Inventory.

Does Louisiana impose an inheritance tax. Credit Caps See the estimated amount of cap available for Solar tax credits and Motion Picture Investor and Infrastructure tax credits. It operates almost like an inheritance tax on the heirs but it is much more severe and it is levied through the INCOME TAX SYSTEM.

Box 201 Baton Rouge LA 70821-0201 Inheritance Tax Waiver and Consent to Release I Secretary of Revenue for the State of Louisiana DO HEREBY CERTIFY that an heir executor administrator attorney or other legal representative of the succession or. State of Louisiana Department of Revenue PO. Increased fuel efficient and revised highway funding laws.

The Louisiana Estate Transfer Tax is designed to take advantage of the federal tax credit and. In order to understand Louisiana inheritance law you need to be familiar with the legal terms usufruct and usufructuary. Pennsylvania Inheritance Tax Safe Deposit Boxes.

The estate transfer tax is calculated by determining a ratio of assets included in the federal gross estate attributable to Louisiana to the total federal gross estate.

Free Covid 19 Liability Waiver Template Rocket Lawyer

Form 8833 Treaty Based Return Position Disclosure Under Section 6114 Or 7701 B 8833

Defense Finance And Accounting Service Civilianemployees Civilian Permanent Change Of Station Pcs Civilian Pcs Entitlement Guide Relocation Income Tax Allowance Rita

Free Vaccine Exemption Form Free To Print Save Download

Illinois Quit Claim Deed Form Quites Illinois The Deed

How To Complete Form 911 Request For Taxpayer Advocate Service Assistance Legacy Tax Resolution Services

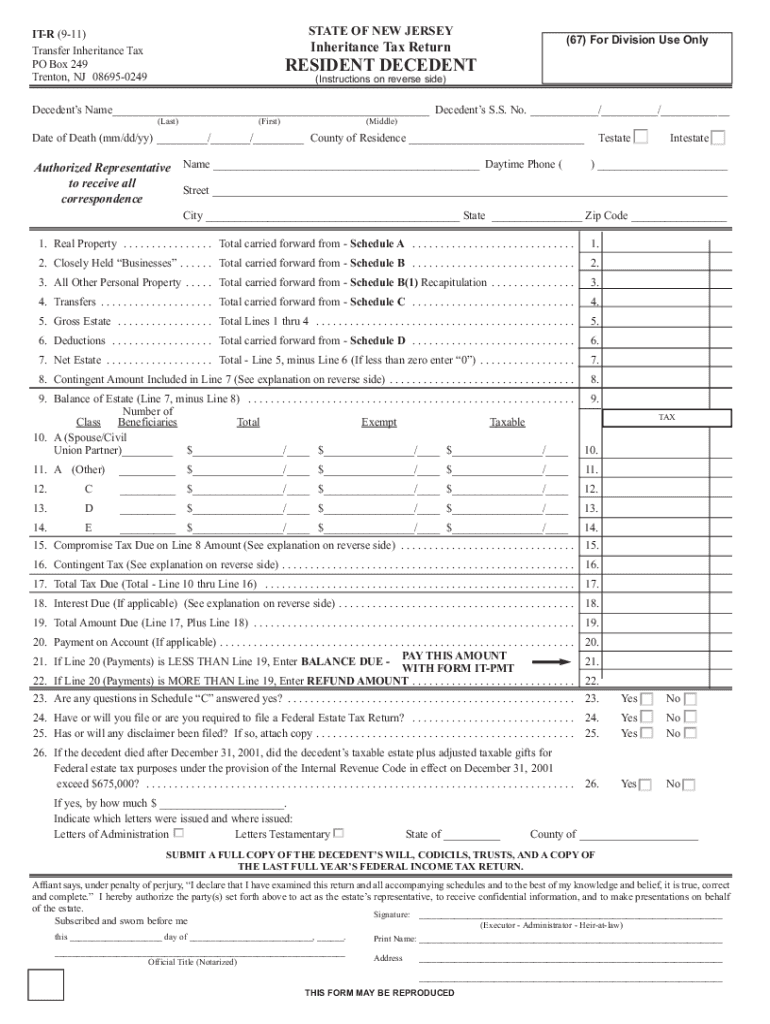

Nj Dot L 9 2019 2022 Fill Out Tax Template Online Us Legal Forms

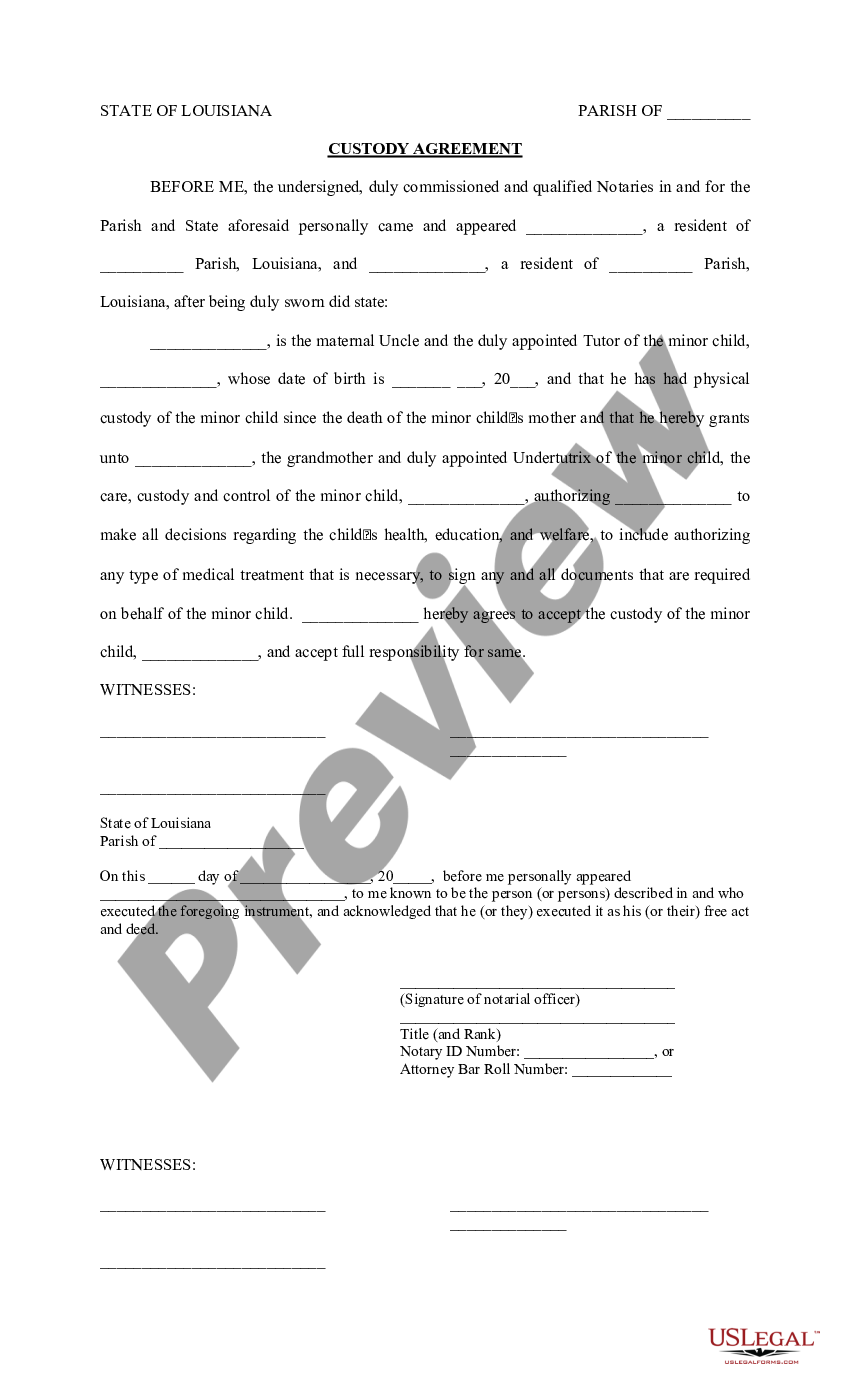

Louisiana Custody Agreement Child Custody Agreement Form Us Legal Forms

Louisiana Inheritance Tax Estate Tax And Gift Tax

Free Rent Landlord Verification Form Word Pdf Eforms

Nj Form It R Fill Online Printable Fillable Blank Pdffiller

Nonresident Real Property Estimated Income Tax Payment Form 2021 It 2663 Pdf Fpdf

What Is A W 9 Tax Form H R Block

Application For Property Tax Exemption Form 136 9284 Indiana

Nj It Estate 2017 2022 Fill Out Tax Template Online Us Legal Forms

Petition For Certificate Releasing Liens Pc 205b Pdf Fpdf Docx Connecticut

Free Direct Deposit Authorization Forms 22 Pdf Word Eforms

Alabama Eviction Notice Free Printable Documents 30 Day Eviction Notice Eviction Notice Real Estate Forms

Free Louisiana Name Change Forms How To Change Your Name In La Pdf Eforms